Al final de un procedimiento de Inspección Tributaria siempre se elabora el correspondiente acta de inspeccion de Hacienda.

Existen varios tipos de actas en función de la postura del obligado ante la propuesta de corrección que le presenta la Administración. Pueden ser Actas con Acuerdo, actas en Conformidad o Actas en Disconformidad.

Al margen de los detalles propios de cada tipo, el acta es, en general, un documento final del procedimiento de Inspección que recoge toda la información sobre dicho procedimiento y las conclusiones finales. Y en ella se incluyen, en su caso, los importes a pagar derivados la corrección de liquidaciones tributarias.

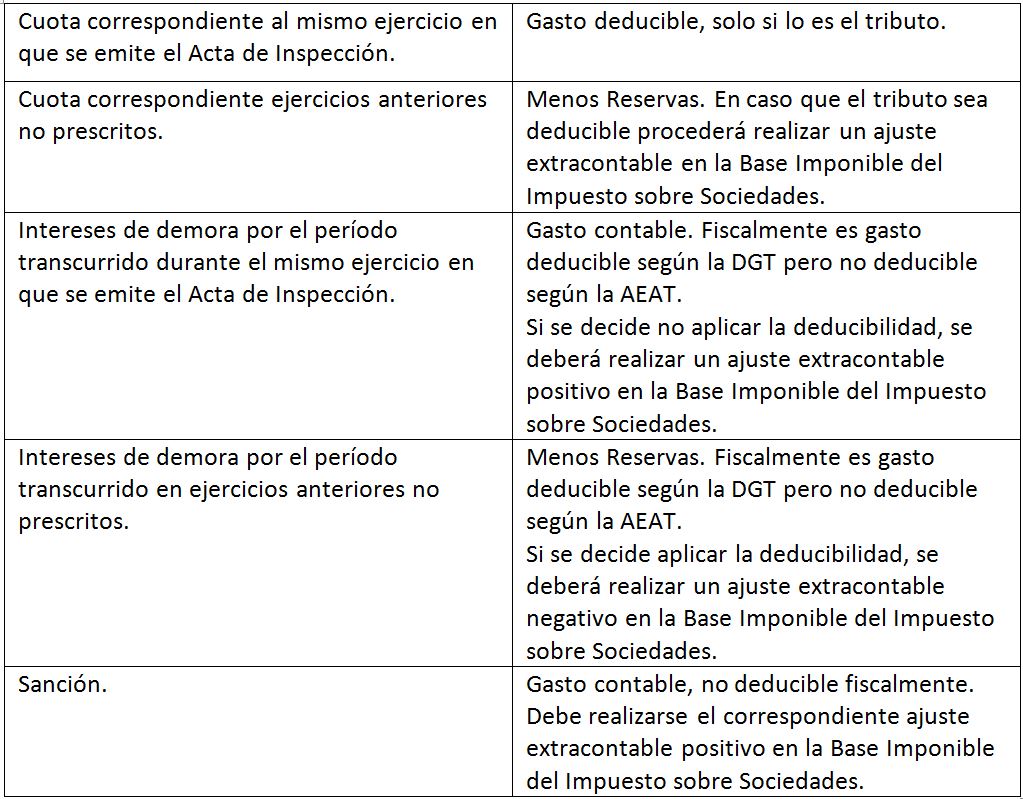

Estos importes a pagar derivados de un Acta de inspeccion de Hacienda se pueden dividir en 3 tipos:

-

Cuota

Es la parte del impuesto que la Agencia Tributaria considera que está pendiente de pago. Es decir, la diferencia entre las declaraciones inicialmente presentadas por el obligado y las liquidaciones corregidas según el criterio de la Agencia Tributaria.

Desde 1/1/2008, con la entrada en vigor del actual Plan General de Contabilidad, estas cuotas solo se tratan como gasto si corresponden a un impuesto del ejercicio en curso. En este caso quedarán reflejadas en la Cuenta de Explotación, reduciendo el beneficio.

En otros casos, las cuotas de ejercicios anteriores deberán contabilizarse contra la cuentas de Reservas, minorándolas y, en consecuencia, minorando también los Fondos Propios de la sociedad.

En algunas ocasiones, aun tratándose de cuotas de ejercicios anteriores, puede que su corrección sea debida a sucesos o información ocurridos durante el ejercicio en curso. En estos casos, podría considerarse que la situación que motiva la corrección es actual y se admitiría la imputación de la cuota como gasto del ejercicio.

-

Intereses de demora

La Agencia Tributaria cobra el coste financiero derivado del retraso en el cobro de la cuota. El tipo de interés de demora suele establecerse por ley cada año (siendo del 3,75% en 2016). Se aplica sobre la cuota a pagar tras la inspección, por el período comprendido desde la fecha en que acabó el pazo voluntario de pago del impuesto corregido, hasta el día de pago efectivo.

Siguiendo el mismo criterio e imputación temporal de gastos que la cuota, los intereses correspondientes al período transcurrido en el ejercicio vigente serán tratados como gasto, en la cuenta contable correspondiente a gastos financieros.

Por el contrario, los intereses correspondiente al periodo de “retraso” que trascurrió en ejercicios anteriores deberán contabilizarse contra la cuentas de Reservas, minorándolas y, en consecuencia, minorando también los Fondos Propios de la sociedad.

Es importante advertir que, actualmente, existe diferencia de opinión con respecto a la deducibilidad fiscal de los intereses de demora, como gasto deducible del Impuesto sobre Sociedades.

Por una parte, la Dirección General de Tributos (DGT) mantiene que dichos gastos no tienen carácter sancionador y, por tanto, son deducibles, según Resolución de 4 de abril de 2016. Por otra parte, el Departamento de Inspección de la Agencia Tributaria (AEAT) mantiene que dichos gastos no son deducibles, en base a una Resolución del Tribunal Económico Administrativo Central de 5 de mayo de 2015. Tendremos que esperar un tiempo para ver cuál es el final de este conflicto de opiniones, que mantiene actualmente al obligado tributario en una incertidumbre inaceptable.

-

Sanción

La sanción se impone en un expediente independiente y se gradúa según diferentes variables. Si bien su importe se contabilizará como gasto del ejercicio, deberá ajustarse en el Impuesto sobre Sociedades, para el cual no se considera deducible.

-

Esquema resumen

Recuerde que, según la normativa contable, los gastos deben contabilizarse desde el momento en que se perciben como previsibles. Así pues, aunque el Acta de inspeccion de Hacienda no sea firme todavía, deberemos dotar la provisión correspondiente dentro del ejercicio en el que ya tengamos conocimiento de su posible existencia.

Sobre el autor:

Inés Gros

DiG Abogados