El suministro informacion inmediata (siglas SII) consiste en el suministro electrónico de los registros de facturación, integrantes de los Libros de Registros del IVA, a través de la Sede Electrónica de la Agencia Tributaria, lo que provocará la configuración prácticamente a tiempo real de los distintos Libros de Registro.

Entrada en vigor de la obligación

La aplicación obligatoria de este sistema se iniciará a partir del 1 de Julio de 2017. No obstante, la información correspondiente al primer semestre de 2017 deberá ser remitida a partir del 1 de julio hasta el 31 diciembre 2017.

¿Quién está obligado?

- Sujetos pasivos que actualmente tienen obligación de autoliquidar el IVA mensualmente (inscritos en el REDEME)

- Grandes empresas (facturación superior a 6.010.121,04 euros)

- Sujetos pasivos acogidos al régimen especial del grupo de entidades del IVA.

También será aplicable a los sujetos pasivos que, voluntariamente, decidan acogerse al mismo (optando en el modelo 036 en el mes de noviembre anterior al año en el que vaya surtir efecto). No obstante, para el ejercicio 2017 la opción puede ejercitarse en el mes de junio de 2017.

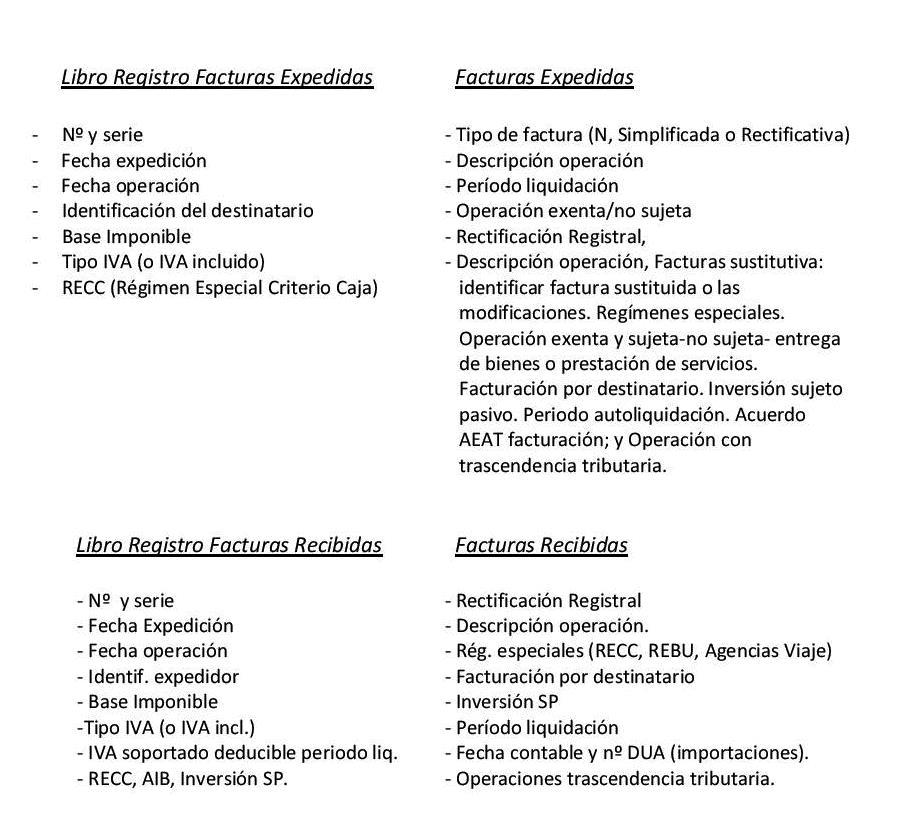

Información sometida al suministro informacion inmediata SII

Deberán comunicarse los siguientes Libros Registro con su información pertinente:

- Libro Registro Operaciones Intracomunitarias

- Libro Registro Información sobre bienes de inversión

El envío de esta información se realizará por vía electrónica, concretamente mediante Servicios Web basados en el intercambio de mensajes XML.

La estructura de este envío tendrá una cabecera común con la información del titular de cada libro registro, así como la información del ejercicio y periodo en el que se registran dichas operaciones. A esta cabecera le acompañará un bloque con el contenido de las facturas.

El suministro informacion inmediata se realizará conforme con los campos de registro que apruebe el Ministerio de Hacienda y Administraciones Publicas a través de la correspondiente Orden Ministerial (pendiente de publicación todavía a fecha de hoy).

Plazos para la remisión de la información

- Facturas expedidas

En el plazo de cuatro días naturales desde la expedición de la factura.

Excepción: facturas expedidas por el destinatario o por un tercero, en cuyo caso dicho plazo será de ocho días naturales.

En todo caso, el suministro informacion inmediata deberá realizarse antes del día 16 del mes siguiente a aquel en que se hubiera producido el devengo del impuesto correspondiente a la operación que debe registrase.

- Facturas recibidas

En un plazo de cuatro días naturales desde la fecha en que se produzca el registro contable de la factura y, en todo caso, antes del día 16 del mes siguiente al periodo de liquidación en que se hayan incluido las operaciones correspondientes.

En el caso de las operaciones de importación, los cuatro días naturales se deberán computar desde que se produzca el registro contable del documento en el que conste la cuota liquidada por las aduanas y en todo caso antes del día 16 del mes siguiente al final del periodo al que se refiera la declaración en la que se hayan incluido.

- Operaciones intracomunitarias

En un plazo de cuatro días naturales, desde el momento de inicio de la expedición o transporte, o en su caso, desde el momento de la recepción de los bienes a que se refieren.

- Información sobre bienes de inversión

Dentro del plazo de presentación del último periodo de liquidación del año (hasta el 30 de enero).

(*) En el cómputo del plazo de cuatro u ocho días naturales a que se refieren los apartados anteriores, se excluirán los sábados, los domingos y los declarados festivos nacionales.

(**) Excepcionalmente durante el segundo semestre del 2017 se amplía a ocho días (en lugar de cuatro) el plazo de presentación de la información.

Reducción de Obligaciones Formales

Se suprime la obligación de presentación de las declaraciones informativas Modelos: 347, 349 y 390.

Si desea obtener más información, puede descargarse el dossier de la Agencia Tributaria con las preguntas más frecuentes sobre el suministro informacion inmediata.

Sobre el autor:

Han Bao Liu

DiG Abogados