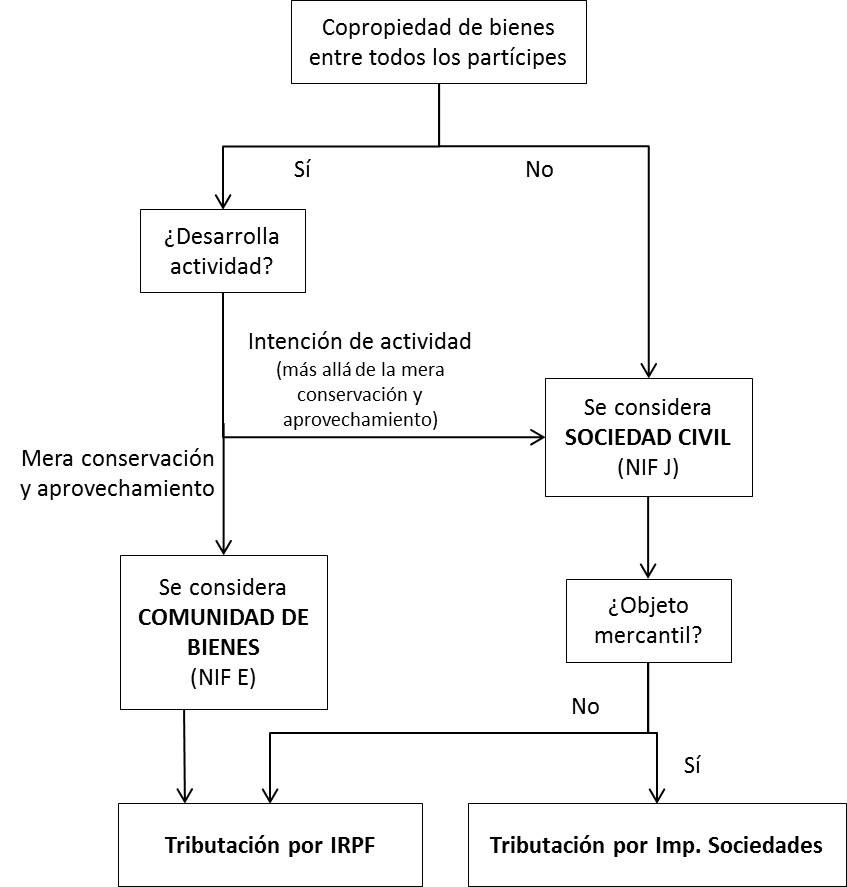

¿Cómo deben tributar las Comunidades de Bienes?

Según comentábamos en artículos previos, a partir de 2016 las Sociedades Civiles con personalidad jurídica objeto mercantil y Comunidades de Bienes, deberán tributar por el Impuesto sobre Sociedades a partir de 2016 (hasta 2015 tributan por el Régimen de Atribución de Rentas del Impuesto sobre la Renta de las Personas Físicas).

- Personalidad jurídica: la tienen todas las sociedades civiles constituidas por escritura pública y también las constituidas mediante documento privado que ha sido aportado ante la Administración Tributaria para la obtención de un Número de Identificación Fiscal.

- Objeto mercantil: organización de elementos materiales y personales para participar en el tráfico mercantil, excluyendo la ocasionalidad. También se excluyen explícitamente las actividades agrarias, forestales, mineras y las de carácter profesional.

¿Cómo tributarán las Comunidades de Bienes?

Según una Instrucción de la Agencia Tributaria, las Comunidades de Bienes que se constituyan para poner en común dinero, bienes o industria, con el ánimo e obtener ganancias comunes, son consideradas Sociedades Civiles y, en este caso, tributarán por el Impuesto sobre Sociedades desde 2016.

De este modo, la Agencia Tributaria otorgará Números de Identificación Fiscal que empezarán por:

- La letra J, para las Sociedades Civiles y a las Comunidades de Bienes que realicen la actividad mercantil.

Éstas tributarán por el Impuesto sobre Sociedades a partir de 2016 (con excepción de las que desarrollen actividades agrarias, forestales, mineras y las de carácter profesional).

- La letra E, para las Comunidades de Bienes dedicadas a la mera conservación y aprovechamiento, que no realicen actividad mercantil alguna.

Éstas tributarán por el Régimen de Atribución de Rentas del Impuesto sobre la Renta de las Personas Físicas.

Nota importante: Lo que determina la obligación de tributar por uno u otro impuesto no es la letra del NIF (puesto que puede haber errores) sino la verdadera naturaleza de la actividad de la entidad.

Sobre el autor:

Inés Gros

DiG Abogados